For decades, the technology industry followed a predictable economic script. Incumbents perfected profitable, product empires. SaaS leaders rewrote the rules with recurring revenue and subscription growth. Everyone optimized for scale, seats, and headcount. That era is formally over.

With the introduction of the TSIA AI 20 Index, TSIA has identified a third, disruptive cohort of public companies whose entire business model is built with an AI-first approach. These companies are not integrating AI into their existing roadmaps. They are creating new markets that could not exist without autonomous intelligence at their core.

And here’s the shift you can’t ignore: They are not competing with you inside your current business model. They are replacing it.

For the first time in modern tech history, you face a dual-pronged threat at once:

- Incumbents risk having core products displaced outright.

- SaaS leaders risk having their seat-based revenue model structurally erased.

This is not a tooling upgrade cycle. This is an economic reset—and the clock is already running.

Key Takeaways

- The TSIA AI 20 represents an entirely new economic species in tech. These companies are engineered for hyper-growth through AI-native platforms that replace—not enhance—legacy software.

- Seat-based pricing is structurally incompatible with AI. As AI reduces human labor, revenue tied to human users declines accordingly.

- Self-disruption is now mandatory. Incumbents that fail to cannibalize their own pricing and product models risk being displaced by challengers that have already done so.

A New Map of the Technology Industry Has Emerged

For years, the technology sector could be understood through two dominant lenses. On one side were the TSIA T&S 50—profitable, blue-chip incumbents that defined the industry through licensed software, long customer lifecycles, and steady but slowing growth. On the other side, were the TSIA Cloud 40—high-growth, born-in-the-cloud SaaS leaders that normalized subscription revenue and recurring billing as the dominant economic model.

The TSIA AI 20 introduces a third force, and it breaks both models at once. These companies are not optimizing how work gets done. They are redefining who—or what—does the work in the first place. Their value-creation engines depend entirely on autonomous artificial intelligence, not on human effort.

Viewed together, the industry now divides into three distinct economic eras:

- T&S 50: stable, profitable, and slow-growth.

- Cloud 40: high growth with low operating margins.

- AI 20: extreme hyper-growth funded by strategic, intentional losses.

Only one of these models was designed for an AI-first economy.

Related: The TSIA AI 20 Index

The Incumbents: Profitable, but Trapped in a Model AI Was Designed To Break

If you lead an established technology business, your company likely reflects the DNA of the T&S 50. You generate substantial profit. You have long-standing customers. And you operate at a scale that once felt invincible. But that stability now rests on increasingly fragile economic foundations.

Over the past decade, product revenue has steadily declined while services have become the dominant growth engine. Transactions have given way to recurring revenue. Customers now measure value in outcomes, not ownership. Even before AI, your business model was under strain.

Now, AI introduces a more profound contradiction. Your most powerful monetization lever—the seat—is fundamentally incompatible with AI's purpose. AI is designed to remove human labor from workflows.

The better AI performs:

- The fewer people your customers need.

- The fewer seats they purchase.

- The weaker your revenue model becomes by design.

This is not a feature gap. It is an economic conflict that compounds with every successful automation cycle.

The SaaS Leaders: Growth That No Longer Guarantees Survival

The Cloud 40 transformed software economics. Subscription revenue scaled globally. Growth became the dominant performance metric. For nearly two decades, markets rewarded expansion over efficiency.

For a long time the trade-off worked. But the conditions that would support a permanent loss are no longer in place. The Rule of 40 was meant to balance growth and profitability. In reality, the Cloud 40 has chronically underperformed. This industry-standard benchmark posits that a healthy SaaS company's annual revenue growth rate plus its profit margin should equal or exceed 40%. And by this measure, the Cloud 40 cohort has, on average, been a chronic failure.

Recent margin improvements across the cohort have come mainly from headcount reductions—not from fundamental business model reinvention. That means the primary cost-cutting lever is already exhausted.

Now the TSIA AI 20 enters with a radically different engine:

- Lower marginal cost at scale.

- Infrastructure-driven growth.

- Revenue expansion without linear increases in sales labor.

You are no longer competing with another sales organization. You are competing with autonomous execution at machine scale.

The TSIA AI 20: A Financial Engine Built for Total Market Capture

What makes the TSIA AI 20 so disruptive is not just what they build—it’s how they fund domination.

These companies combine rapid revenue growth with significant operating losses. From the outside, that profile can look reckless. In reality, it reflects a deliberate strategy: absorb short-term financial pain to secure long-term control of the platform.

Those losses represent:

- Investment in foundational AI models.

- Proprietary data pipelines.

- Massive infrastructure build-outs.

- Platform-scale defensibility.

This is not startup fragility. It is an overinvested, economic strategy designed to lock in entire markets before competitors can respond.

Related: How AI Economics™ Is Disrupting the Biggest Names in Tech

The Three Phases of an AI-Native Company: How the TSIA AI 20 Actually Scales to Dominance

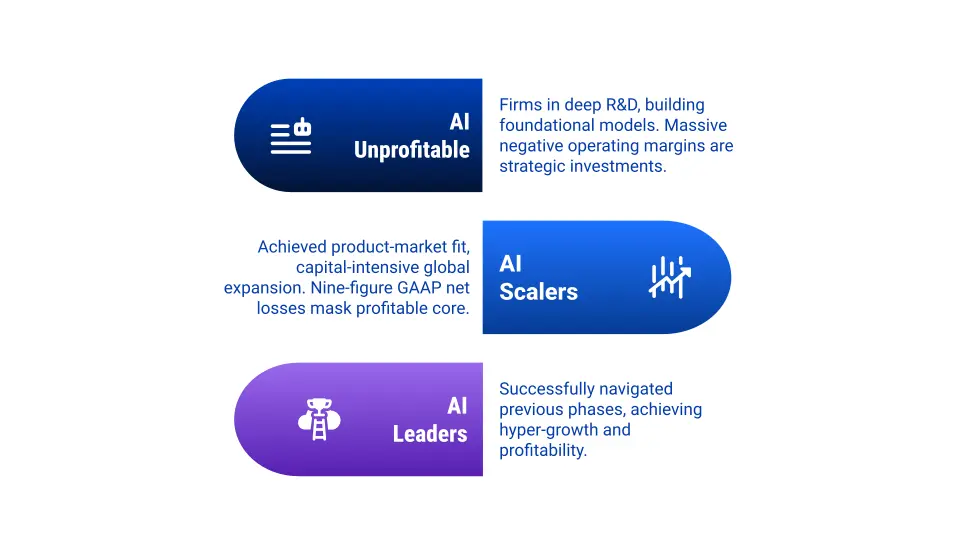

One of the most critical insights from the TSIA AI 20 Index is this: AI-native companies do not follow a single financial pattern. They follow a predictable evolutionary ladder.

This is what separates temporary disruption from permanent industry leadership. The AI 20 is not a random group of high-risk, money-losing innovators. It is a live blueprint for how next-generation technology giants are built. Each company in the index fits into one of three distinct phases—each with a different economic purpose.

Phase 1: AI Unprofitable

Companies like AbCellera, Recursion, and C3.ai represent the deep R&D phase. This is where losses run into multi-hundred-percent negative operating margins as firms invest aggressively in foundational models, proprietary IP, and platform infrastructure. These losses are not failures. They are strategic investments in long-term dominance.

Phase 2: AI Scalers

Companies such as CoreWeave, Upstart, and Lemonade have achieved product-market fit and are now investing massive capital into global expansion. Nine-figure GAAP losses are common—but these often mask a profitable operational core. The red ink reflects deliberate infrastructure financing, not broken economics.

Phase 3: AI Leaders

Companies like Palantir, CrowdStrike, and SentinelOne represent the graduates of the AI 20 model. They generate hyper-growth and real profitability simultaneously. This is where legacy SaaS logic completely breaks down. Once a company reaches this phase, it gains access to compounding reinvestment advantage—capital that allows it to out-build, out-scale, and out-innovate any legacy rival indefinitely.

Related: AI Economics.™ TSIA’s Perspective on Profitable AI Business Models

The Real Threat Isn’t Adoption—It’s Disintermediation

The most misunderstood risk in the AI era is still framed around the pace of adoption. The real danger is replacement. Traditional software exists to enable human work. AI-native systems are designed to replace the core functionality of existing B2B software. Autonomous agents now observe, decide, and act without requiring user input.

That is why seat-based pricing now faces existential risk. As AI reduces the number of people required to generate outcomes, revenue tied to human access collapses automatically. This is disintermediation, not enablement, and it is already unfolding.

Why “Bolt-On” AI Only Delays the Inevitable

Most incumbents respond with feature-level AI tactics: copilots, workflow automation, and more innovative dashboards. These moves improve productivity, but they do not solve the economic contradiction.

If your revenue still depends on human users, every successful AI efficiency gain actively undermines your own growth engine. You cannot feature-patch your way out of a broken monetization model. At some point, the model itself must be rebuilt.

Cannibalization Is Now a Strategic Requirement

Every technological reset eventually forces the same decision. Do you disrupt your own advantage before someone else destroys it for you?

In the AI era, cannibalization is no longer a risk—it’s the only survivable strategy. This requires:

- Actively breaking away from seat-based pricing.

- Rebuilding value around outcomes and execution.

- Accepting short-term disruption in exchange for long-term survival.

This is not a transformation by accident. This is an offensive transformation—or rather, extinction.

The End of Comfortable Incumbency

The TSIA AI 20 Index does not represent a market trend. It means a foundational rupture in technology economics. You are no longer competing on release velocity alone. You are competing on economic architecture. And the challengers are not waiting for your migration roadmap to catch up.

The next decade of technology leadership will be claimed by the companies that choose to dismantle their own success while they still have the leverage to do it on their terms. Everyone else will be rewritten by forces they no longer control.

FAQ

What is the TSIA AI 20 Index?

The TSIA AI 20 Index is a proprietary cohort of public companies whose entire business model, differentiation, and revenue engine are built natively on artificial intelligence. These firms are AI-first—not AI-assisted.

Why is the AI 20 a threat to both incumbents and SaaS leaders?

For incumbents, AI-native systems replace core products directly. For SaaS leaders, autonomous systems undermine the seat-based subscription model by reducing the number of human users required to generate outcomes. This creates a dual-front economic collapse.

Why can’t seat-based pricing survive the AI era?

Seat-based pricing monetizes human access. AI monetizes autonomous execution. As AI eliminates labor from workflows, revenue tied to people erodes automatically.

Smart Tip: Embrace Data-Driven Decision Making

Making smart, informed decisions is more crucial than ever. Leveraging TSIA’s in-depth insights and data-driven frameworks can help you navigate industry shifts confidently. Remember, in a world driven by artificial intelligence and digital transformation, the key to sustained success lies in making strategic decisions informed by reliable data, ensuring your role as a leader in your industry.

.png)

.png)